Firstly, due to the increasing demand for autonomous driving and new energy vehicles, the size of the automotive storage chip market will continue to expand, with DRAM and NAND as the demand focus. It is expected that the number of DRAM and NAND per vehicle will increase by 5 times/10 times in 21-25 years, and the value of each vehicle will increase by more than 4 times. Overall, the automotive storage market size will reach 8.8 billion US dollars in 25 years.

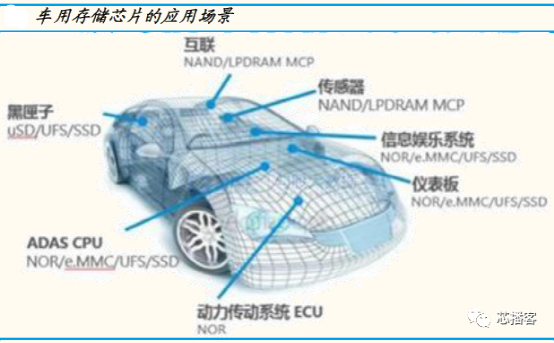

Storage chips can be divided into flash memory and memory, including NAND hnstshop.com/" target="_blank">FLASH and NOR FLASH, and memory mainly consists of DRAM. From the perspective of application form, the specific products of NAND Flash include USB (USB flash drive), flash card, SSD (solid-state drive), and embedded storage such as eMMC, eMCP, UFS. Storage chips are widely used in intelligent and electric vehicles, and the implementation of system functions such as intelligent cockpit, vehicle networking, autonomous driving, information entertainment, instrument panel, black box, and power transmission all require storage technology to provide parameters. Autonomous driving places higher demands on the computing power and storage capacity of automotive memory chips; New energy vehicles need to improve charging speed and ensure battery life, as well as continuously upgrade storage chip technology.

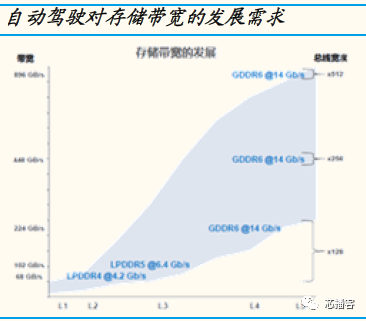

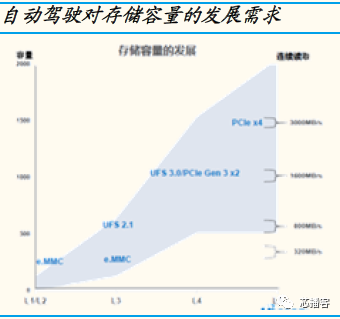

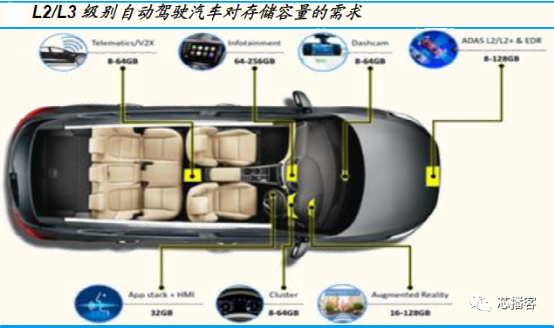

With the improvement of autonomous driving level, the demand for automotive chip computing power and storage capacity continues to rise. According to the data of the Prospective Industry Research Institute, at present, the auto drive system code of a high-end car exceeds 100 million lines, and the autopilot software calculation volume reaches the magnitude of 10 trillion operations per second, far exceeding aircraft, mobile phones, Internet software, etc. With the increasing penetration rate and level of autonomous driving in the future, the number of lines of code in automotive systems will show exponential growth, requiring high bandwidth DRAM for reading and writing. DRAM will move from DDR32/4GB to LPDDR48GB. In the process of automotive automation, various sensors used to collect data on vehicle operation and surrounding conditions will gradually increase. It is necessary to collect external environmental data of the vehicle at all times, which will inevitably generate a large amount of data processing and storage needs. In addition to the data generated by car driving itself, real-time information sharing, interactive communication, and data exchange between cars will also generate huge storage needs.

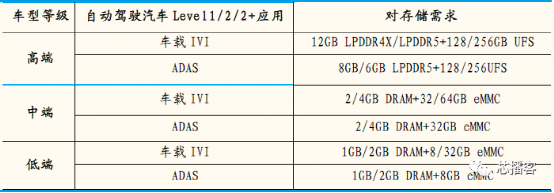

The driving force of smart cars on storage chips mainly comes from four major fields: in car infotainment systems (IVI), advanced driving assistance systems (ADAS), in car information systems, and digital instrument panels. Among them, IVI accounts for about 80% of the total storage product usage, and ADAS accounts for about 10%. Due to the current widespread use of Level 1/2/2+for autonomous driving, the demand for storage capacity is still very limited. Some high-end models are equipped with at most 12GB DRAM and 256GB UFS, which are equivalent to the current flagship smartphone; In mid range models, 2/4GB DRAM and 32/64GB eMMC are common configurations; In low-end models, DRAM and eMMC have lower capacity requirements, requiring only 1/2GB and 8/32GB. According to Canalys data, 11.2 million L2 autonomous vehicle will be sold in the world in 2020. If the average carrying capacity is 8GB, L2 autonomous vehicle will consume about 90PB NAND Flash.

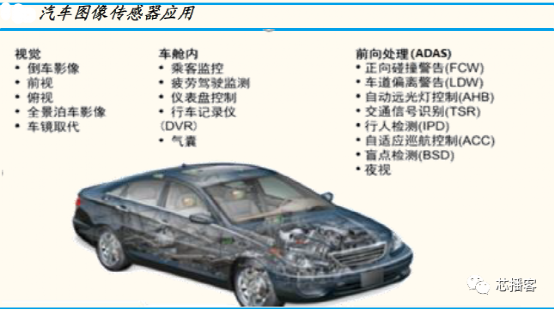

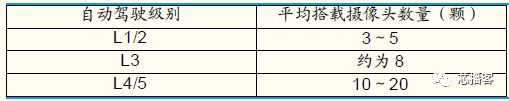

Secondly, the improvement of autonomous driving level will also promote the continuous improvement of the number and pixels of car cameras, corresponding to the continuous increase in car CIS. It is expected that the number of cameras equipped on a single car will increase from 2 in 21 to 6 in 25, and the value of a single car will increase from $18.8 to $57.8. It is estimated that the global car CIS market size will reach $5.75 billion by 25. The intelligence of automobiles has led to the emergence of multiple application scenarios for automotive CIS, and the market space for automotive CIS is vast. The application scenarios of automotive CIS in intelligent vehicles are very extensive, mainly divided into three categories: vision, in cabin, and forward processing of advanced driving assistance systems (ADAS). Vision includes reverse view, front view, rear view, top view, panoramic parking image, and mirror replacement. It is used for passenger monitoring, fatigue driving monitoring, instrument panel control, driving recorder (DVR), airbags in the cabin, and advanced driving assistance system (ADAS) for forward processing such as forward collision warning, lane departure warning, automatic high beam control, traffic signal recognition, pedestrian detection, adaptive cruise control, night vision, and so on. The expansion of the application field of automotive CIS has given rise to broad market prospects.

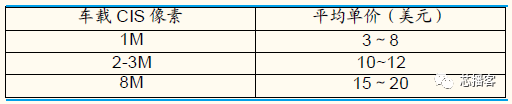

The improvement of autonomous driving level has driven both the quantity and price of CIS vehicles. In terms of quantity, autonomous driving can be divided into L0-L5 levels. As the level increases, the number of cameras installed in the on-board ADAS system increases, with 1 camera in L1 level, 5-8 cameras in L2 level, and more than 8 cameras in L3 level. It is expected to require 10-15 cameras in L4/L5 stage. In terms of price, from L0-L5, the requirements for in car camera pixels and anti-interference are constantly increasing, requiring clear object images to be captured during high-speed vehicle movement. The demand for continuous technological iteration has increased the value of automotive CIS. Generally, a L1 level autonomous vehicle equipped with a rear view camera usually requires CIS pixels of less than 2M, 3~8 dollars per camera, L2/L3 of 2~3M, L4/L5 of 3~8M, and the unit price is 10~20 dollars.

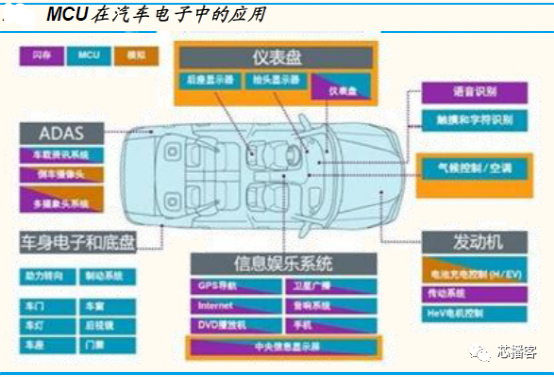

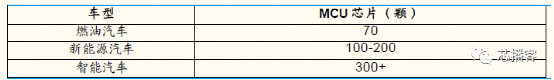

In addition, the demand for automotive electronic intelligent vehicle MCUs has doubled (about 70 traditional automotive MCUs, 100-200 new energy vehicles, and over 300 L2 level or above automotive MCUs). In 2020, the global automotive MCU market size was 6.6 billion US dollars, and it is expected to reach 8.8 billion US dollars by 2023. The electronic intelligence of automobiles, the Internet of Things, and the lack of chips have made automotive MCUs the most promising chip segment market. Traditional cars require dozens of MCUs. With the trend of automotive automation and electrification, the electronic and electrical architecture has been restructured, and MCUs are widely used in dashboard, climate control, entertainment information, body electronics and chassis, as well as ADAS systems. The demand for MCUs is increasing exponentially.

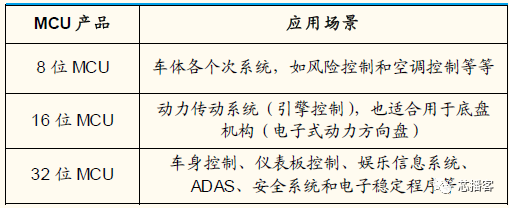

Vehicle MCU is the world's largest application field for MCU products, and different digit MCU products are suitable for different application scenarios. In 2020, the proportion of automotive electronics, industrial control, consumer electronics, and healthcare in the global MCU market was 35%, 24%, 18%, and 14%, respectively. Among them, MCU is the most widely used in the field of automotive electronics. The market demand for on-board MCU is mainly concentrated in 8-bit, 16 bit, and 32-bit microcontrollers, with application scenarios including various subsystems of the vehicle body, power transmission system and vehicle control, instrument panel control, entertainment information system, ADAS, and safety system. The complexity of application scenarios increases as the number of MCU products increases.

The trend of electrification and intelligence in automobiles has led to a doubling of the demand for automotive MCUs. MCU is mainly used in the core aspects of safety and driving, including control of autonomous driving (assistance) systems, display and calculation of central control systems, engine, chassis, and body control, with a wide range of applications. A traditional fuel powered vehicle requires around 70 MCU chips, while a new energy vehicle requires 100-200 MCU chips. Intelligence will also drive the growth of the automotive MCU market. The ADAS hardware scheme for L2 and below still adopts the traditional distributed architecture, and sensors and MCU processors coexist in the edge hardware module. The increase in the penetration rate of autonomous vehicle below L2 will certainly bring about the demand for automobile MCU. At the same time, the entertainment information system, network system and auto drive system in intelligent cars also have a large demand for MCU chips. As a whole, each intelligent car is expected to use more than 300 MCU.

Beijing Ziguang Xinneng Technology Co., Ltd. (referred to as "Ziguang Xinneng") was established in 2019 and is an automotive chip design company. The core team of the company comes from Tsinghua University and Ziguang. The company focuses on the design and development of high-performance automotive domain control chips and related power and interface chips, and was the first to launch the THA6 series automotive domain control chips by the end of 2021.

The THA6 series products have a maximum eFLASH space of 10MB and have obtained AEC-Q100 Grade1 reliability certification, ISO26262 ASIL-D level functional security product and process certification. They support eVita Full level information security and are equipped with up to 5 sets of dual core lock step kernels, with a maximum main frequency of 300MHz and a computing power of over 4000DMIPS. They are embedded with high-capacity Flash and SRAM, and integrate rich AD and GTM resources; Supporting security OTA upgrades for A/B partitions, equipped with multiple network interfaces including 1Gbps Ethernet, CAN-FD, and LIN, fully supporting the stringent requirements of the next generation E/E architecture for the main control chip. It can be applied to new energy vehicle power domain VCUs, BMS, motor control, traditional fuel vehicle power domain ECUs, ADAS controllers, as well as future distributed domain control, central domain control, and other fields. At present, the chip has successfully completed millions of kilometers of road testing and has received unanimous praise from both domestic and foreign professionals.

="" width="600" height="400" />

="" width="600" height="400" />