Product recommendation: Car standard resistors

hnstshop.com/product-list/R15-p1-l10.html" target="_blank">

The intelligent driving industry is entering a triple turning point of technology, regulations, and user acceptance, and the second half of the battle for electric vehicles begins

The second half of the new energy vehicle race is about to begin, from electrification to intelligence.

In 2022, the penetration rate of China's new energy vehicle market reached 25.6%, a year-on-year increase of 12.1 percentage points, with global sales accounting for over 60%. With the increasing penetration rate of electric vehicles, software level intelligence will be the key to forming competitive differentiation, and intelligent driving will trigger a new round of reshuffle in the automotive industry.

In order to further enhance the competitiveness of vehicle models and expand market share, high-quality domestic brands have made improving the intelligent driving level of new vehicle models the next key task. At present, domestic intelligent driving vehicles have developed to the stage of assisted driving. According to data from high-tech intelligent vehicles, in 2022, the standard front mounted assisted driving (L0-L2) for passenger cars in the Chinese market (excluding imports and exports) will be delivered, with a front mounted loading rate exceeding 50% for the first time.

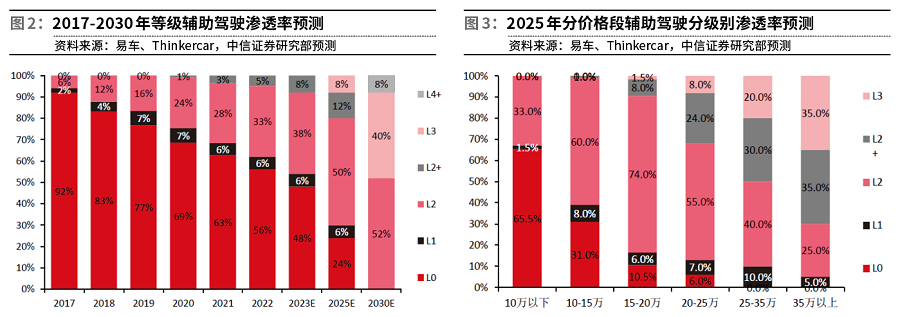

L3 is a key watershed in the intelligent driving industry chain. According to data from Yiou Think Tank, the penetration rate of L2 level autonomous driving was 9% in 2020, 18% in 2021, and is expected to increase to 25% for L2 and above autonomous driving in 2022, 37% by 2025, and 5% for L3 and above.

Industry insiders are even more optimistic at the China Electric Vehicle Hundred People Conference, with the penetration rate of advanced intelligent driving exceeding 15% by 2026, completing the cross gap of intelligence. That is to say, the next three years will be a critical window period, and intelligent driving technology is the key to winning.

As a benchmark enterprise in the global electric vehicle industry, Fully Automated Driving (FSD) is an upgraded version of Tesla's Autonomous Pilot, which aims to enable vehicles to operate completely automatically without human intervention and be safer than human drivers. Since its launch to some users in 2020, FSDBeta has gone through more than ten iterations over the past three years, each of which has been accompanied by increasing openness and intelligence. Musk once revealed that users of the FSDBeta version have traveled a total of 190 million miles (approximately 306 million kilometers).

On July 6th, Musk made an online appearance at the World Artificial Intelligence Conference and stated, "It is very convincing that FSD will be implemented in 2023."

CITIC Securities stated that after three years of testing, Tesla FSD has built solid barriers in algorithms, data, hardware, and other aspects. Although still classified as an L2+product, it may already have preliminary L3 capabilities and overall positive user reviews. In North America, FSD has arrived on the eve of its official launch and is expected to officially remove Beta in the next generation V12 version and penetrate a wider range of consumers. Outside of North America, Tesla is also actively promoting the implementation process of FSD, and the trend of entering China is becoming increasingly clear, which is expected to accelerate the overall intelligent process of Chinese car companies.

In terms of domestic car companies, companies such as Ideal, Xiaopeng, NIO, Huawei, etc. have launched models that can achieve urban and high-speed navigation assisted driving (NOA) functions. Companies such as BYD, Great Wall, and Changan have also increased their research and development efforts.

Huaxi Securities stated that the intelligent driving industry follows a development path of "spiral upward and wave forward", and the turning point of Tesla's FSD is evident in 2023; The acceleration of NOA implementation in cities such as Ideal, Xiaopeng, NIO, and Huawei; Policies and regulations are gradually improving; Tesla's custom supercomputer platform Dojo will be launched in July and is expected to accelerate data accumulation. The intelligent driving industry is gradually entering a triple turning point of technology, regulations, and user acceptance. We are optimistic about the functional experience improvement brought by the accumulation of subsequent data and the application of large models, which will improve driving safety, reduce driving fatigue, and gradually influence consumer car purchasing decisions. The intelligent layout is expected to be the most direct benefit for leading car companies and components.

According to research data from Dongwu Securities, the size of China's autonomous driving market was 50 billion yuan in 2020, and it is expected to exceed 110 billion yuan in 2023, with a compound annual growth rate of 28%.

From electric to intelligent

The first half of the competition in the automotive industry was about electrification, while the second half was about intelligence.

"2022 is a landmark year for the development of the global new energy vehicle industry, with annual sales exceeding 10 million vehicles for the first time, a year-on-year increase of 63.6%. China continues to implement new energy vehicle support policies such as finance, taxation, point management, and road traffic, and the industry has delivered a brilliant answer." said Xin Guobin, Deputy Minister of Industry and Information Technology.

Statistical data shows that in 2022, China's sales of new energy vehicles reached 6.887 million units, a year-on-year increase of 93.4%, accounting for 25.6% of the total sales. The target for 2025 was achieved three years ahead of schedule. In the first quarter of 2023, China's new energy vehicles made a good start, with production and sales reaching 1.65 million and 1.586 million respectively, an increase of 27.7% and 26.2% year-on-year, and a market share of 26.1%.

Dongfang Wealth Securities stated that the biggest change in the passenger car market in the past few years has come from the rapid growth of electric vehicles, which have rapidly increased their penetration rate in new car sales. From 2021 to May 2023, it has reached a level of around 35.3%, reaching its peak of 38.3% in November 2022. The future electric vehicle market will gradually enter a stable and high-speed growth stage from an explosive growth stage.

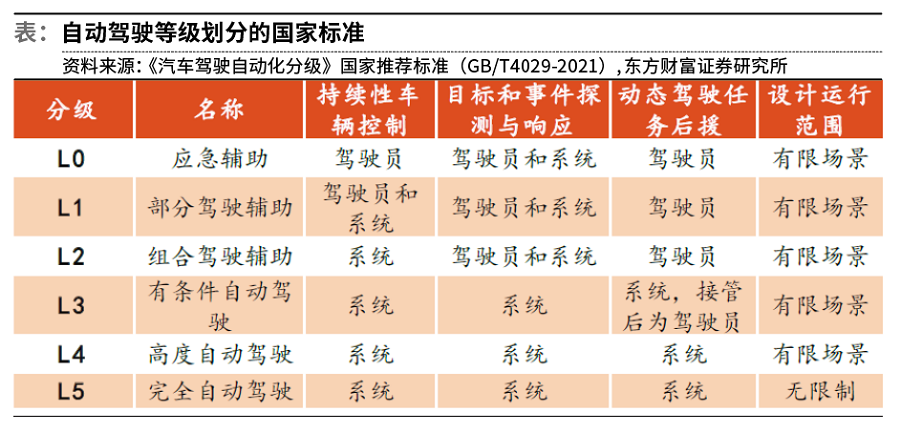

The electrification of automobiles has laid a solid foundation for intelligence. According to the latest national standard, autonomous driving technology is divided into six levels: L0 to L5. At present, L2 level autonomous driving technology has been widely adopted on electric vehicle platforms, and its penetration rate has increased at a pace similar to that of electric vehicles, reaching a level of 34.9% in 2022. According to the summary of information released by major manufacturers on mass-produced vehicle models, starting from 2022, it will enter a new stage of mass production of L3 autonomous driving technology.

Legislative breakthroughs accelerate the implementation of autonomous driving. In May 2022, the Shenzhen Municipal People's Congress made the Shenzhen Special Economic Zone Intelligent Connected Vehicle Management Regulations the top priority in its legislative plan. According to the draft for soliciting opinions, it is mainly clarified that L3 level autonomous vehicles can legally operate on open road sections, regions, or district wide open roads, and that drivers of L3 level autonomous vehicles are liable for damages in the event of accidents. Drivers who cause accidents due to quality defects can seek compensation from car manufacturers and sellers. Its future implementation will solve key issues that constrain the development of the industry, such as the legal use of L3 vehicles on the road and the division of accident responsibilities, which is of milestone significance. It is expected to trigger legislation in various regions to significantly promote the popularization of L3 level autonomous driving technology.

On May 16, 2023, Miao Changxing, a first level inspector of the Equipment Industry Department of the Ministry of Industry and Information Technology, stated that the Ministry of Industry and Information Technology will resolutely implement the decisions and deployments of the Central Committee of the Communist Party of China and the State Council, adhere to the integrated development path of vehicle, road, and cloud, strengthen overall coordination, innovation driven development, optimize policy supply, and work together to promote the high-quality development of the intelligent connected vehicle industry.

Xin Guobin also stated, "We will support conditional autonomous driving (L3 level autonomous driving) and the commercial application of higher-level autonomous driving functions, and will release a new version of the Intelligent Connected Vehicle Standard System Guide. We have initiated this work and local authorities are actively responding.". In addition, the Ministry of Industry and Information Technology revealed in mid May that the "Guidelines for the Standard System of Intelligent Connected Vehicles" will be officially released, accelerating the development of more than ten key and urgently needed standards, including support for the commercial application of autonomous driving functions above L3 level.

According to the latest national standard driving automation classification standard GB/T40429-2021 implemented on March 1, 2022, the biggest change of L3 level automatic driving is the detection and response elements of targets and events, from the L2 level completed by the driver and the system together to the L3 level completed by the system independently, which puts forward higher requirements for the target detection capability of the auto drive system.

At present, the mainstream route of autonomous driving technology includes: firstly, a gradual evolution route, starting from the production of Advanced Driver Assistance Systems (ADAS) products and gradually developing them to the autonomous driving stage. Most traditional car and component companies generally adopt this relatively conservative route.

The second is a revolutionary route, starting with the development of L4 or L5 level autonomous driving by companies such as Google, Ford, General Motors (GM), Momenta, etc.

The third is Tesla's route, which adheres to pure visual autonomous driving hardware. Firstly, it applies auxiliary autonomous driving functions, continuously accumulates test data, and improves the autonomous driving system through software upgrades and deep learning, ultimately achieving autonomous driving.

Tesla's three levels of intelligent driving products, from low to high, are Basic, Enhanced (EAP), and FSD. FSD is Tesla's intelligent driving product aimed at achieving fully autonomous driving, and it is currently in the beta version (test version).

FSD Beta started pushing V6.0 to small batches of early testers as early as October 2020. After multiple iterations, the latest version, FSD Beta V11.4.2, was released on May 30, 2023. It can achieve three domain intelligent driving functions including high-speed navigation, urban road navigation, and parking. Currently, real-time monitoring by drivers is still required, and it belongs to L2 advanced assisted driving.

Among them, the basic and enhanced versions of the models sold in China have been launched, while FSD is currently only available in North America (the United States and Canada) and has not yet been introduced in China. However, it can be purchased with a paid option and can only be installed when FSD is introduced in China.

The two major technological foundations for FSD implementation are the perception algorithm architecture of BEV+Transformer and the Dojo supercomputing system. The former provides FSD with perception and localization capabilities that do not rely on high-precision maps, while the latter supports algorithms to quickly iterate and respond to user feedback, achieving efficient data closed-loop.

As of January 2023, 400000 North American users have connected to FSD Beta, corresponding to a penetration rate of approximately 25%. According to CICC's calculations, North American FSD is expected to contribute $823-1711 million to Tesla's revenue in 2023, accounting for approximately 1.0% -2.1% of its total revenue in 2022. Based on its gross profit margin of 65%, it is expected to contribute $823-1711 million, 535-11.12 billion, accounting for 2.6% -5.3% of Tesla's gross profit in 2022. In terms of user base, Musk believes that once FSD's scale and data accumulation cross a certain threshold, it will also experience explosive growth like ChatGPT. According to Loop Funds, 80% of Tesla cars will be equipped with FSD by 2031, which will bring Tesla a profit of $102 billion by 2032.

The promotion of Tesla FSD is expected to enhance consumer awareness of advanced assisted driving, boost the configuration rate of intelligent driving in the industry, further cultivate consumer demand for advanced assisted driving functions, and activate the driving force for the development of the autonomous driving industry. Comparing the landing environments in China and the United States, as well as the data and training prerequisites required for BEV+Transformer technology, CICC believes that if FSD wants to enter China, it needs to consider whether the BEV (pure electric) perception scheme can be well localized and adapted. The opening of city navigation assistance functions such as Tesla FSD and Xiaopeng XNGP may accelerate the development process of China's intelligent driving industry.

On June 15th, Xiaopeng Motors announced the official opening of its urban NGP in Beijing, becoming the first high-level intelligent assisted driving in the industry to be opened in the urban area of Beijing. It is currently mainly suitable for various ring roads and major expressways in Beijing. And it will soon be pushed to the Max version users of Xiaopeng G9 and P7i.

On June 17th, Ideals released the cognitive big model MindGPT, urban NOA for "light high precision maps", and commuting NOA solutions - solving the problem of using fourth - and fifth tier cities by learning the road segment characteristics of the set route through self driving, which will effectively accelerate the penetration rate of assisted driving systems.

The penetration rate is increasing

As technology gradually matures, product prices gradually decrease, and the demand for intelligent user experience continues to increase, ADAS functions are gradually developing from luxury cars to mid to low-end models, and penetration rates are rapidly increasing.

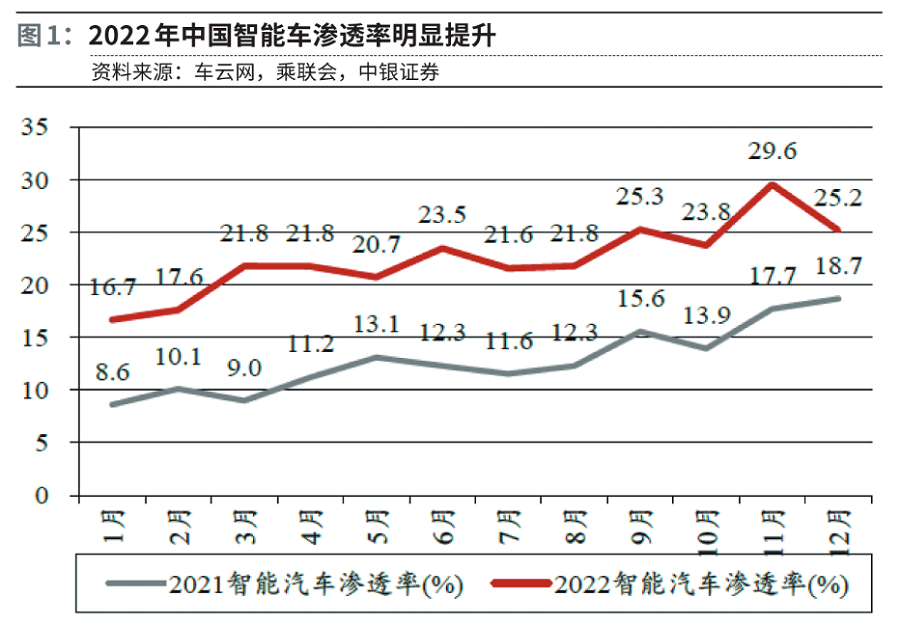

According to data from Gaogong Intelligent Automobile, in 2022, the Chinese market (excluding imports and exports) delivered 10.0122 million passenger cars equipped with standard front mounted assisted driving (L0-L2), a year-on-year increase of 23.9%, maintaining a relatively high growth rate. According to data from Cheyun Network, in 2022, China's sales of intelligent connected vehicles and intelligent connected passenger vehicles (with OTA function and L2 level or above intelligent driving assistance function) reached 4.688 million units, a year-on-year increase of 77.7%, and the penetration rate reached 22.6%.

Bank of China Securities stated that the ADAS system is not only a progressive solution for car companies to enter autonomous driving, but also a commercial product of autonomous driving achievements at present. Affected by factors such as increased production scale effect, localization of some products, and increasing technological maturity, the cost of assisted driving is gradually decreasing. According to data from Gaogong Intelligent Automobile, from 2020 to 2022, the average price of L2 level assisted driving front equipped models was 272000 yuan, 256000 yuan, and 252000 yuan, respectively, with models priced below 250000 yuan accounting for nearly 80% in 2022. The auxiliary driving function is gradually penetrating the mainstream consumption range, and sales are expected to continue to grow rapidly.

NOA was first introduced by Tesla to FSD models in 2019 (which can correspond to the "advanced intelligence/intelligence+navigation/navigation+automatic/assisted driving" functions of different car companies, referred to as NOP+by NIO, NGP by Xiaopeng, and NCA by Huawei). Based on the basic L2 assisted driving function, it can achieve point-to-point intelligent driving within a certain range of road scenes by combining with map navigation and other functions. Navigation assistance can be seen as a combination of functions such as ACC (Adaptive Cruise Control), LCC (Lane Centering Control), and ALC (Automatic Lane Change Assistance). Based on this, it combines high-precision map navigation, sensor information, and planning algorithms to achieve intelligent driving functions such as automatic following, lane changing, up and down ramps, and speed control.

According to different scenarios, navigation assistance can be further divided into high-speed navigation and urban navigation. High speed navigation is generally limited to specific highways and urban elevated roads, while urban navigation is upgraded for complex urban road scenes, adding functions such as signal light recognition, automatic lane changing, and automatic obstacle avoidance.

The high-speed NOA scene is relatively simple, and the images of road conditions, signs, and markings are relatively standard. When driving on closed sections such as highways or elevated roads, the technology function of combining vehicle navigation routes to enable vehicles to automatically change lanes, enter and exit ramps is relatively widely used.

The accelerated implementation of urban NOA covers major driving scenarios, providing users with sustainable autonomous driving functions across all scenarios from highways to cities. Early urban NOA functions commonly used high-precision maps to provide more precise positioning services, but high-precision map collection costs were high, coverage was low, and updates were slow, making it difficult to meet the rapid and large-scale boarding needs of urban NOA. With the iterative upgrading of vehicle computing power and sensor functions, the level of bicycle perception is constantly improving. Most manufacturers adopt a "light map"+bicycle perception solution, which only strengthens data in areas where navigation maps such as ramps are difficult to accurately process, to achieve urban NOA function. As the urban NOA technology route gradually matures, a large number of mid to high end vehicle models are gradually being configured, and the related industry chain is expected to develop rapidly.

According to a report from Huaxi Securities, from the end of 2020 to 2022, Ideal, Xiaopeng, NIO and others have successively launched high-speed navigation assisted driving functions; In 2023, NOA will move from high-speed to urban areas, and independent car companies represented by new forces (such as Ideal, Xiaopeng, NIO, and Huawei) will have plans to implement urban assisted driving within the year (based on the total mileage of users, urban roads account for 71%, and the driving time reaches 90%).

According to data from Gaogong Intelligent Vehicles, from January to April 2023, the actual delivery volume of standard NOA models was 112000, a year-on-year increase of 85.3%, and the number of newly delivered NOA configuration models increased by about 20%. At the same time, the average price of standard NOA function models continues to decline. According to data from Gaogong Intelligent Automobile, from January to April 2023, the average price of NOA standard delivery models was 353000 yuan, a year-on-year decrease of 9.4%.

L3 is gradually entering the mass production stage, and some models have reached the standard. L3 level automatic driving has the ability to completely perform dynamic driving tasks (DDT) in a limited environment similar to expressway. In the face of auto drive system failure, vehicle failure or other emergencies, the driver should take over with the minimum risk as far as possible. For L3 and above autonomous vehicle, the support of domain controller, chassis by wire and laser radar is generally required. Some manufacturers have achieved L3 level system layout in 2022, but due to regulatory requirements, they cannot fully use it. At present, regulations are gradually being relaxed for high-level autonomous driving.

Shenzhen will implement the Shenzhen Special Economic Zone Intelligent Connected Vehicle Management Regulations from August 1, 2022. This document provides a detailed definition of the definition, testing and demonstration application conditions, and ownership of intelligent connected vehicles. It is the first official management document in the country to provide a detailed division of important issues such as the rights, responsibilities, and definitions of autonomous driving for L3 and above. With the successive launch of L3 models and the continuous opening of regulations, the related fields will experience rapid development.

Huatai Securities believes that urban NOA, "commuting mode" boarding, and Tesla FSD are expected to accelerate the implementation of L3 level autonomous driving. It is expected that the penetration rate will quickly increase to 10% by 2025, driving a significant expansion of the automotive zero track.

CITIC Securities has a more optimistic forecast, with an expected penetration rate of 38% and 8% for L2 and L2+level autonomous driving in the short term by 2023. In 2023, with the launch of products such as Ideal L7/L8, Xiaopeng G6, and NIO New ES6, it is expected that the penetration rate of L2+level products will continue to increase. In the medium term, it is expected that the penetration rate of L2, L3 and above level autonomous driving will be 56% and 20% respectively by 2025.

Intelligence is the core trend in the automotive industry, and OEMs will maintain strong demand for autonomous driving. It is expected that the penetration rate of L2 level autonomous driving will be 50% and 52% respectively by 2025 and 2030; With the advancement of autonomous driving technology, the decrease in related component costs, and the gradual relaxation of laws and regulations, it is expected that the penetration rate of L3 and above level autonomous driving will be 20% by 2025; Subsequently, L4 began to emerge and will further increase to 40% and 8% in L3 and L4 by 2030.

Dongfang Wealth Securities stated that the upgrade of L3-L5 autonomous driving levels will bring a longer high-speed growth cycle. According to the development experience of the electronics industry, the process of increasing the penetration rate of new technologies often goes through slow, fast, and slow rhythm changes. The fastest growth period starts around 10% penetration rate and reaches the 80% percentile of the final penetration rate ceiling.

From an investment perspective, the best investment opportunity comes from this period. Compared to the one-dimensional penetration rate improvement process of automobile electrification, the greater charm of the intelligent track lies in the fact that, on the basis of L2, the popularization of L3, L4, and L5 in the future will bring a staggered triple penetration rate increase and a high-speed growth period, resulting in a longer high-speed growth period and greater growth space. At present, the penetration rate of L2 is increasing at a similar rate to the popularization of electrification. Assuming that the promotion speed of each level of L3-L5 is similar to that of L2, it is expected that the high growth of the entire automotive intelligence track will continue for 6 years.

The Road to Reviewing Earnings

Fortune Securities reviewed the sales situation, sector returns, and excess returns of individual stocks in the passenger car industry from 2005 to present. From a time perspective, the investment range of the entire passenger car sector can be roughly divided into three stages: first, the production capacity cycle from 2005 to 2010, during which the supply of automotive products is in short supply, industry sales are growing rapidly, and sector returns are significantly outperforming the Shanghai Composite Index. During these 5 years, the industry has achieved high beta returns.

The second is that from 2010 to 2020 is the product cycle, during which the industry's growth rate gradually slows down, the structure shows differentiation, the sector's earnings fluctuate greatly, and the industry's beta returns decrease. During this period, vehicle companies with strong product capabilities still have good alpha returns.

Thirdly, starting from the first half of 2020, the automotive industry has entered a period of rapid development in electrification and intelligence. The beta returns of the industry have significantly increased. The overall sales of the automotive industry have maintained slight growth, with internal structural differentiation. The penetration rate of new energy vehicles has rapidly increased, and the market share of traditional fuel vehicles has significantly declined. Domestic brands are continuously increasing their market share in China with their first mover advantages in electrification and intelligence. Some excellent domestic brands are accelerating their overseas expansion and expanding their global market share.

From 2005 to 2010, industry sales grew rapidly, and investment followed the total amount. From 2005 to 2010, the passenger car industry was in a rapid development stage, with a 5-year CAGR of 28.2%. Stimulated by the purchase tax preferential policy from 2009 to 2010, the industry's growth rate in the two years was 52.88% and 33.29%, respectively. The rapid growth of industry sales has driven the rapid increase in revenue and performance of passenger car companies.

The performance of the passenger car sector is improving, with industry investment returns significantly outperforming the Shanghai Composite Index. In 2007 and 2009-2010, the passenger car sector achieved 3-5 times excess returns compared to the Shanghai Composite Index. This is also positively correlated with the overall revenue and performance growth rate of the passenger car sector.

During the period of rapid increase in industry sales, individual stocks also have high investment returns. Taking Changan Automobile as an example, the company's sales growth rate was 21.0% in 2007, and the sales growth rates in 2009 and 2010 were 74.4% and 58.3%, respectively. During the same period, the company's stock price increased by 4-5 times compared to early 2007 and early 2009, respectively.

2011-2020: The overall growth rate of the industry slowed down and internal structure differentiated. After 2011, the growth rate of industry sales began to decline, with a CAGR of 3.7% from 2011 to 2020. The internal structure of the industry has differentiated, and passenger car companies with strong products have emerged from their own alpha market. During this period, vehicle companies with strong products achieved high sales growth and also achieved high excess returns. Taking Changan Automobile and Great Wall Motors as examples, the year-on-year sales growth rates of Changan Automobile from 2013 to 2016 were 13.9%, 14.5%, 8.9%, and 10.3%, respectively. During the same period, the company's stock price also rose from 3.0 yuan at the beginning of 2013 to the highest point of 11.1 yuan in 2015, an increase of 2.7 times. The year-on-year sales growth rates of Great Wall Motors from 2012 to 2016 were 28.4%, 20.7%, -3.1%, 16.7%, and 26.0%, respectively. The corresponding company's stock price also rose from 3.15 yuan at the beginning of 2012 to the highest point of 16.32 yuan during the period, an increase of 4.2 times.

Since 2021: Intelligent electric vehicles have led the industry's transformation, and related indices have achieved excess returns. Since 2021, the overall growth rate of the industry has slowed down, and the internal structure differentiation has become more significant. The penetration rate of new energy vehicles, represented by electrification and intelligence, is rapidly increasing. The new energy vehicle index and intelligent vehicle index have achieved high excess returns, and companies that have laid out electric intelligent vehicles earlier have also achieved high excess returns.

BYD has an early layout in the new energy field, with a deep accumulation of three electric technologies, sufficient production capacity of power batteries, and a highly vertically integrated component supply chain. With its first mover advantage, BYD has enjoyed the industry dividend in this intelligent electric transformation, and its sales and market value have repeatedly reached new highs.

Opportunities in the field of sensing

BOC Securities said that L2+and above autonomous vehicle need support from sensing (vision, laser radar, 4D millimeter wave radar), computing (domain controller, high computing chip), execution (chassis controlled by wire) and other aspects. With the successive launch of L3 models, the related fields will experience rapid development.

In recent years, the penetration rate of intelligent driving, intelligent cockpit, and intelligent chassis has rapidly increased, driving the rapid growth of the carrying capacity of products such as LiDAR, millimeter wave radar, domain controller, HUD, air suspension, wire controlled braking, and steering. The technology of some domestic component suppliers is gradually maturing, with significant cost and location advantages. There is broad room for domestic substitution, and market share is expected to increase significantly.

Huaxi Securities stated that there has always been a competition between pure visual solutions and LiDAR solutions in the industry. From the development of Tesla FSD, relying on algorithm framework upgrades and large model applications, the reliability of pure visual routes has been improved. At the same time, when combined with 4D millimeter wave radar applications, good perception effects can be formed; For subsequent progress, it is not only a technical route dispute, but also a comprehensive choice related to efficiency, cost, and safety, which is also a suitable way for various car companies to choose based on their current reality. Therefore, for domestic car companies, considering the lack of technical capabilities and data accumulation in the short term, the LiDAR route is expected to remain one of the more deterministic technical solutions.

The laser radar route is clear, and low-cost mass production is the core competitiveness. Among them, the hybrid solid-state LiDAR technology route is relatively mature, with good stability, low price, simple structure, and easy to pass vehicle regulations, and is still the current mainstream solution.

According to data from the Intelligent Automotive Research Institute of Gaogong, in 2022, in the Chinese market (excluding import and export), passenger cars will be equipped with 129900 standard lidars and 111800 supporting vehicles. Lidars will still be an important sensor for achieving L2 level and above driving assistance functions. Multiple models equipped with LiDAR will be mass-produced in 2022, but the penetration rate is still relatively low, mainly equipped in models with advanced autonomous driving functions. Lidar, as an important guarantee of perception security, will gradually increase its penetration rate in the future with technological updates and continuous cost reductions. According to calculations by Bank of China Securities, the LiDAR market in China's passenger car market will reach 12.91 billion yuan in 2025, with a compound growth rate of 128.3% from 2021 to 2025.

CITIC Securities also stated that due to its advantages of direct, stable, and accurate measurement, LiDAR can directly perceive dark and dazzling scenes at night, as well as situations that cannot be recognized by visual algorithms in advanced driving assistance applications. When the visual ability is not strong enough, it can provide a "safety bottom line" for car companies. Low performance LiDAR has a simple structure and lower cost, and the cost of a single LiDAR is expected to decrease to 1000 yuan or even lower. If the Bill of Materials (BOM) drops below 8000 yuan, advanced assisted driving is expected to significantly penetrate the 200000 yuan passenger car market.

With the gradual penetration of intelligent driving, millimeter wave radar, as an important perception sensor, is expected to significantly increase its market size. According to data from Gaogong Intelligent Automobile, the sales of millimeter wave radars reached 17.953 million units in 2022, a year-on-year increase of 31.2%.

Bank of China Securities believes that the penetration rate of millimeter wave radar is still at a relatively low level, and the L1 and L2 level assisted driving is still mainly based on the 1V1R scheme. Considering the increased penetration rate of the relatively advanced L2 level autonomous driving function and the increase in the required number of sensors, it is expected that the average required millimeter wave radars for L1 and L2 levels will be 1.5 and 2.7 respectively by 2025, and the number of L3 level and above will increase to 5-10. Considering the gradual maturity of millimeter wave radar technology, increasing shipment volume, further cost reduction, and the gradual replacement of domestic products, it is expected that prices will experience a certain degree of decline in 2025. According to calculations by Bank of China Securities, the millimeter wave thunder market in China's passenger car market will reach 11.79 billion yuan in 2025, with a compound growth rate of 25.3% from 2021 to 2025.

At the same time, there is a clear trend of upgrading millimeter wave radar, and 4D millimeter wave radar is gradually being installed in vehicles. 4D millimeter wave radar has significant advantages over traditional millimeter wave radar in terms of wide viewing angle, high resolution, and the ability to detect still life.

Firstly, traditional millimeter wave radar is unable to obtain altitude information, which is effectively compensated by 4D radar. Some products have a vertical field of view angle of up to 30 °, which can effectively detect obstacles such as overpasses, height limit poles, and road signs. Secondly, 4D radar detection is more accurate, with a resolution of less than 1 ° and an accuracy of less than 0.1 °. Thirdly, 4D radar can recognize stationary obstacles. 4D radar can recognize stationary points due to dense point clouds.

Better performance can enable 4D millimeter wave radar to effectively support higher-level intelligent driving, and the price is around 1000-1500 yuan, which is much lower than LiDAR in the short term. According to a research report by Bank of China Securities, currently in the application of domestic car models, models such as SAIC Feifan R7 (2 pieces, supplied by ZF), Changan Shenlan SL03 (1 piece, supplied by Senstec), Ideal L7 (1 piece, supplied by Senstec), Geely Lotus Eletre (2 pieces) are all equipped with millimeter wave radar, which is expected to achieve upgrades.

In terms of market share in millimeter wave radar, overseas giant Tier1 (a first tier automotive supplier) holds a major position. According to the data of Gaogong Intelligent Automobile, in the first quarter of 2023, the top five suppliers of supporting role radars for the front mounting standard of passenger cars in China's market share are: Haila, Ambofu, Weininger, Sensec and Bosch, with market share of 22.8%, 17.0%, 15.9%, 13.4% and 10.8% respectively, and CR5 of 79.9%. At present, domestic manufacturers mainly focus on angle radars with lower difficulty, with only manufacturers such as Sensitek, Huayu, Zero Run (self-developed), Huawei, etc. achieving mass production of front mounted millimeter wave radars for passenger cars. With the gradual launch of products from companies such as Chuansu Microwave and Desai Xiwei, there is broad room for domestic substitution, and the market share is expected to continue to increase.

Opportunities in the field of computing

With the increase in the number of intelligent driving functions, the intelligent driving domain control has significantly increased. With the development of electronics and intelligence, traditional distributed architectures have gradually evolved into domain centralized architectures, and "domains" and "domain controllers" have emerged.

According to data from Gaogong Intelligent Automobile, in 2022, the Chinese market (excluding import and export) passenger cars will be equipped with 1.147 million intelligent driving new vehicle domain controllers as standard equipment (excluding optional equipment), a year-on-year increase of 81.3%.

With the continuous development of autonomous driving and the continuous improvement of autonomous driving functions, there has been a significant increase in computing power. Autonomous driving domain controllers are expected to penetrate at a high speed, and there is a trend of increasing the proportion of high-end products. Bank of China Securities predicts that in the future, there will be a double increase in quantity and price for autonomous driving domain controllers.

At present, some manufacturers have laid out low-end and cost-effective products for L1 and L2, and it is expected that L1 level autonomous driving vehicles will gradually be applied in the future, and costs will gradually decrease with mass production. According to calculations by Bank of China Securities, the autonomous driving domain controller market in China's passenger car market will reach 34.71 billion yuan in 2025, with a compound growth rate of 93.6% from 2021 to 2025.

The composition of a domain controller is mainly divided into two parts: hardware and software. As the center of automotive computing decision-making, the implementation of domain controllers mainly relies on the organic combination of multi-level software and hardware such as the main control chip, software operating system, middleware, algorithms, etc. The domain controller includes hardware (main control chip, etc.) and software (underlying basic software, middleware, and upper layer application algorithms).

In terms of hardware, Bank of China Securities believes that high computing power chip solutions are still essential for core vehicle models, and the penetration of medium and low computing power chip solutions is accelerating. In 2023, competition in the automotive industry intensifies, and major automakers still consider product strength as their core competitiveness. Intelligent configuration is an important manifestation of product strength. In 2023, mainstream brand flagship products will still maintain a high level of domain control solution configuration, providing hardware support for their intelligent driving function. At the same time, the intention of the host factory to reduce costs is obvious. For models under 200000 yuan, intelligent driving domain control products based on Orin-N, TDA4 and other low to medium computing power chip solutions are also constantly being launched, supporting the integration of parking and transportation, which is expected to accelerate the penetration of non equipped models and improve the intelligent driving performance of products with low to medium prices.

Manufacturing and software capabilities remain the core competitiveness of suppliers in the short term. The autonomous driving domain controller has extremely high safety requirements, and requires high hardware design and safety testing capabilities from domain control suppliers. With the rapid increase in domain control capacity, Tier1's cost control capability and production capacity level are also important competitive advantages. At the same time, constrained by factors such as capital density and talent structure, most host manufacturers find it difficult to comprehensively layout various aspects of domain control software and hardware design and development, and require domain control suppliers to provide underlying software and algorithm solutions.

As a frontline area for user interaction, intelligent cabins have become the mainstream in the market. According to monitoring data from the High Tech Intelligent Automotive Research Institute, in 2022, the Chinese market (excluding import and export) passenger cars will be equipped with 7.951 million intelligent cabins as standard, with a loading rate increasing to 39.9%. From the demand side perspective, the cockpit is the most direct interaction area with users. With the increasing demand for intelligent experience, personalized functions, comfort, and convenient operation, the demand for intelligent cabins is rapidly increasing. From the supply side perspective, the development difficulty of cockpit functions is low, and the safety requirements are low, which can be quickly commercialized. And the cockpit is easily perceived by consumers, which is also one of the directions for car companies to enhance product competitiveness.

The cabin functions are gradually increasing and becoming more complex, and the number of traditional distributed architecture ECUs is constantly increasing. Integrating computing units from a domain dimension to form a computing architecture based on functional domains effectively reduces the complexity of the architecture and the number of ECUs. Compared to chassis and intelligent driving domain control, cabin domain control is more responsible for in car entertainment systems. Its chips have a higher similarity to consumer electronics chips, and have relatively low safety requirements and development difficulties. The high demand and relatively low threshold promote a rapid increase in the penetration rate of cockpit domain control.

According to monitoring data from the High Tech Intelligent Automotive Research Institute, in 2022, 1.727 million passenger cars in the Chinese market (excluding imports and exports) were equipped with cockpit domain controllers as standard, a year-on-year increase of 47.6%. Considering the upward trend of cockpit domain controllers, Bank of China Securities predicts that the market size of cockpit domain controllers will reach 21.49 billion yuan by 2025, with a compound growth rate of 56.2% from 2021 to 2025. There are many participants in the cockpit domain controller, and Bank of China Securities is optimistic about a domain control supplier with excellent design, manufacturing, and supply capabilities.

The head up display (HUD), as the core product of the cockpit display, will see a surge in volume. The main function of HUD is to display information such as speed and navigation on the front windshield, allowing drivers to obtain key information during driving without bowing their heads, thereby improving driving safety and comfort. HUD has evolved from C-HUD to W-HUD and then to AR-HUD. Currently, W-HUD is the main focus, while AR-HUD is gradually emerging, providing better performance experience and more suitable for displaying ADAS and other information.

According to monitoring data from the High Tech Intelligent Automotive Research Institute, in 2022, 1.5 million passenger cars in the Chinese market (excluding imports and exports) were delivered with W/ARHUD as standard equipment, a year-on-year increase of 38.1%. The front loading rate was 7.5%, and the proportion of models priced between 150000 and 250000 yuan was relatively high. Up to 1.411 million optional delivery models are available. Considering the gradual maturity of HUD technology and the emerging economies of scale in mass production, prices are expected to continue to decline. Bank of China Securities predicts that the HUD market size will reach 20.02 billion yuan in 2025, with a compound growth rate of 77.7% from 2021 to 2025.

The domestic substitution of HUD is expected, and the market share of domestic companies is rapidly increasing. In the early days, HUD was mainly supplied by overseas suppliers such as Jingji, Mainland China, and Dianzhuang, and was installed on luxury models of foreign brands. Starting from 2020, a large number of high-end models from domestic and joint venture brands began to be equipped with HUD, and the market share of domestic suppliers also rapidly increased. As supply side costs decrease, the demand for HUD functionality from demand side consumers increases, leading to a rapid increase in HUD penetration rate and gradually penetrating into the low price range.

The regulations for streaming rearview mirrors have been lifted, and the carrying capacity is expected to rapidly increase. Due to restrictions such as policies and regulations in various countries, the electronic exterior rearview mirror (CMS) product has not yet been widely adopted in the market. With the development of automotive intelligence, electronic exterior rearview mirrors have been the first to be released in Europe, and countries such as Japan have also introduced regulations. In December 2022, the State Administration for Market Regulation and the National Standardization Administration issued the "Performance and Installation Requirements for Indirect Vision Devices for Motor Vehicles". Starting from July 1, 2023, electronic rearview mirrors are allowed to be installed in domestic vehicles.

Streaming rearview mirrors have significant advantages in imaging effects and other aspects, improving driving safety and driving experience. Compared to optical rearview mirrors, streaming rearview mirrors have advantages such as small blind spots, minimal external impact, integrated ADAS function, and reduced wind resistance.

Overseas manufacturers are allowed by policies to develop their industries earlier than domestic ones, leading in product mass production and installation progress. At present, the main manufacturers include Magna, Ficosa, and others. Some domestic manufacturers have advanced their technological layout, such as Huayang Group launching the second-generation electronic exterior rearview mirror in 2022, which integrates ADAS function and has been designated by domestic host manufacturers; Guangting Information can provide customized software development and technical services related to streaming media rearview mirrors; In early 2023, Ningbo Huaxiang acquired Ningbo Fengmei Video and expanded its CMS electronic rearview mirror business; Desai Xiwei and other enterprises also have relevant technological reserves.

Opportunities in the field of execution

Intelligent chassis systems are divided into two major products: air suspension systems and lightweight chassis systems.

The stability requirements of the chassis system of new energy vehicles are much higher than those of pure fuel vehicles. Air suspension systems have gradually become the mainstream configuration of new energy vehicle platforms, and new energy vehicles such as Tesla, NIO, and Ideal have begun to be equipped with air suspension systems.

At present, driven by multiple factors such as localization, electrification, and consumer upgrading, the price of air suspension systems is gradually decreasing, exploring incremental markets. One is that domestic manufacturers have obvious cost advantages in components and a clear trend towards localization. Compared to imported original parts, the decrease in added value due to technological maturity has led to a decrease in research and development costs, and the scale effect of fixed-point increase in mass production has gradually increased. In addition, due to factors such as tariffs and transportation costs, the unit price of domestically produced air suspension system related components has significantly decreased.

The second is the increasing demand for air suspension in new energy vehicles. On the one hand, new energy vehicles are more sensitive to their range, and air suspension can to some extent improve their range. On the other hand, new energy vehicles have a higher weight, and traditional suspension affects the driving experience.

Thirdly, the upgrading of consumption has led to an increase in demand for air suspension. At present, air suspension is gradually penetrating into models priced between 250000 and 400000 yuan, with a significant decline compared to previous models priced at 700000 yuan or above, which is in line with the price range of independent high-end brands and brings broader market space.

Bank of China Securities predicts that the size of China's passenger car air suspension market is expected to grow rapidly in 2025. In 2021, the penetration rate of air suspension is still at a low level due to factors such as cost, technology, and production capacity. With the acceleration of the localization of core components, the cost of air suspension will be significantly reduced, and the average single vehicle value of air suspension systems is expected to decrease by more than 40%; At the same time, with the production lines of local manufacturers and the increase of compatible models, the market size of air suspension is expected to grow rapidly in the coming years. Bank of China Securities predicts that the overall penetration rate of air suspension will reach 17% in 2025, with a market size of 29.55 billion yuan and a CAGR of 24.5% from 2021 to 2025.

At the same time, the penetration rate of domestic substitution has increased, and the number of designated key enterprises has grown rapidly. In the early stages, there was a significant gap between domestic and overseas suppliers, mainly reflected in the fact that overseas assembly suppliers had a better understanding of the entire industry chain, with better quality and performance guarantees; Overseas suppliers have rich experience in design and production, shorter development cycles, and faster troubleshooting. With the increase of R&D investment, domestic suppliers have rapidly improved their technology, gradually matured their products, narrowed the gap, and highlighted their cost and service advantages. The designated procurement volume of key domestic air spring suppliers is rapidly increasing, and domestic penetration is expected to increase rapidly.

Compared to mechanical structures, wire controlled braking systems have a fast response and significant advantages in achieving advanced assisted driving; At the same time, the simple structure and large cost optimization space are also one of the reasons why the host factory has a high willingness to use. With the gradual mass production of domestic brands and obvious geographical advantages, coupled with the continuous shortage of chips by overseas enterprises, the local supply chain is relatively stable, and it is expected to achieve domestic substitution.

The loading rate of wire controlled braking is rapidly increasing, and Bank of China Securities predicts that the penetration rate will reach 50% by 2025. According to data from Gaogong Intelligent Automobile, in 2022, the number of insured vehicles delivered with hydraulic brake (EHB) systems as standard equipment for passenger cars in the Chinese market (excluding imports and exports) was 4.974 million, a year-on-year increase of 56.6%, and the front-end loading rate reached 25.0%. The scale effect of mass production and the demand for cost reduction from host manufacturers have driven component manufacturers to reduce costs, resulting in a decrease in product prices. Bank of China Securities predicts that the price of Two Box will drop to around 1500 yuan, and One Box will also experience a certain degree of decline. The autonomous driving function is constantly advancing, and the demand for line control is gradually increasing. In addition, the technology is gradually maturing, and the cost is decreasing. The penetration rate is expected to rapidly increase. According to calculations by Bank of China Securities, the wire controlled braking market in China's passenger car market will reach 15.64 billion yuan in 2025, with a compound growth rate of 40.1% from 2021 to 2025.

Overseas component suppliers of braking systems have a first mover advantage, while domestic manufacturers are quickly catching up. Bosch, Continental, ZF and other overseas Tier 1 production lines have early control and deep technological accumulation, making them the main mass production enterprises in the market. Among them, Bosch is to some extent in a leading position, officially launching iBooster as early as 2013, becoming the world's first enterprise to launch iBooster. Currently, it has the largest mass production and the widest range of supporting solutions. Its second generation product uses a first level ball screw for deceleration, significantly reducing volume and weight, and improving power. At the same time, this solution has high energy recovery efficiency, lighter weight, and shorter response time, with excellent performance.

Wire controlled steering is currently in its early stages and is expected to gradually increase in volume in the future. The development of wire controlled steering is still relatively immature. On the one hand, the development of hardware ECU and functional redundancy of wire controlled steering are limited, and on the other hand, sufficient redundancy of the chassis also brings difficulties in mass production and development, resulting in high overall costs. Bank of China Securities predicts that the penetration rate of line control shifting to 2025 can reach 7%. Considering that the wire controlled steering has not yet been mass-produced, it is difficult for prices to significantly decrease in the short term. According to calculations by Bank of China Securities, the Chinese passenger car market's wire controlled steering market will reach 5.32 billion yuan in 2025, with a compound growth rate of 301.6% from 2022 to 2025.

The above article information is sourced from the internet. If there is any infringement, please contact and delete the post.